About Aviation Deal Tracker | Airfinance Journal

About Aviation Deal Tracker | Airfinance Journal

Airfinance Journal Deals Methodology

What is a deal?

A deal in the report is considered as a finalized transaction (mandated or closed) between one or more financial institutions and an airline or leasing company borrower/issuer. It can be backed by certain assets or not.

Some of the basic deal parameters which are analyzed on the report are:

- Secured: The deal has collateral associated

- Unsecured: The deal has no collateral associated

- Refinanced: The deal is to repay another loan

- New financing: The deal is not intended to repay another one

- Capital markets: The Capital source comes from the debt or the equity capital markets

- Non capital market sources: The capital source is a bank, a credit society, a hedge fund or another non-public source

- Aircraft purchase: The funds are to buy aircraft

- General corporate purposes: the funds are for general purposes, including gaining liquidity, financing equipment, buildings, etc

Country/Region

The country is where the borrower/issuer/lessee is based.

Deal categories

Commercial Loans

Commercial loan category includes the following subtypes:

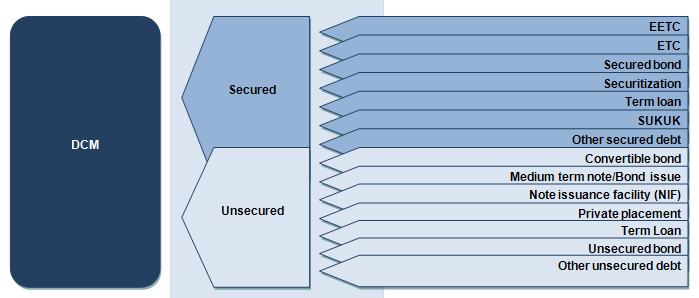

Debt Capital Markets

Commercial loan category includes the following subtypes:

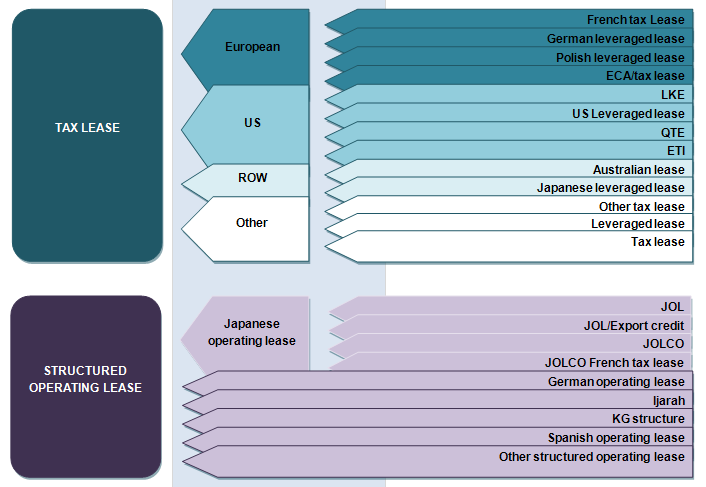

Structured Operating lease/ Tax Lease

Includes the following subtypes:

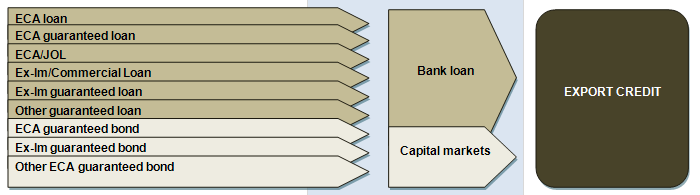

Export Credit

Includes the following subtypes:

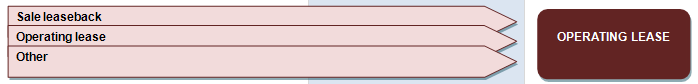

Operating lease

Includes the following subtypes:

Equity capital markets

Includes the following subtypes:

To speak with us directly, please contact:

Mario Walker

Chief Revenue Officer

+44 20 7779 8223

mario.walker@airfinancejournal.com