European Aviation Finance News & Insights | Airfinance Journal

Play maintains zero EBIT outlook

LCC has as much restricted cash as unrestricted cash

Pegasus Airlines closes engine financing

Airfinance Journal’s Fleet Tracker shows that the Turkish carrier operates 89 A320/A321neos.

Latest News

Airbus needs €1bn EBIT increase to hit target: Jefferies

26 Apr 2024 Aircraft EuropeEuropean OEM Airbus maintains its full-year guidance for commercial aircraft amid continued supply chain tension.

Norwegian reports positive EBITDAR margin

25 Apr 2024 Airlines EuropeAircraft financing related debt amounted to NOK 13.46 billion at the end of the first quarter

Airfinance Journal Rising Stars: part 2

25 Apr 2024 Law EuropeIn part 2, Airfinance Journal recognises three of the six most promising legal associates for 2024

Turkish Airlines expands lease deal with CDB Aviation

24 Apr 2024 Airlines EuropeCDB Aviation will now have seventeen aircraft on lease to the carrier

Jet2 forecasts substantial EBIT rise

24 Apr 2024 Airlines EuropeShows 32% increase on the prior year, according to The Airline Analyst

Pegasus keeps EBITDAR margin at 30%: The Airline Analyst

24 Apr 2024 Airlines EuropeFitch affirms Pegasus Airlines ratings

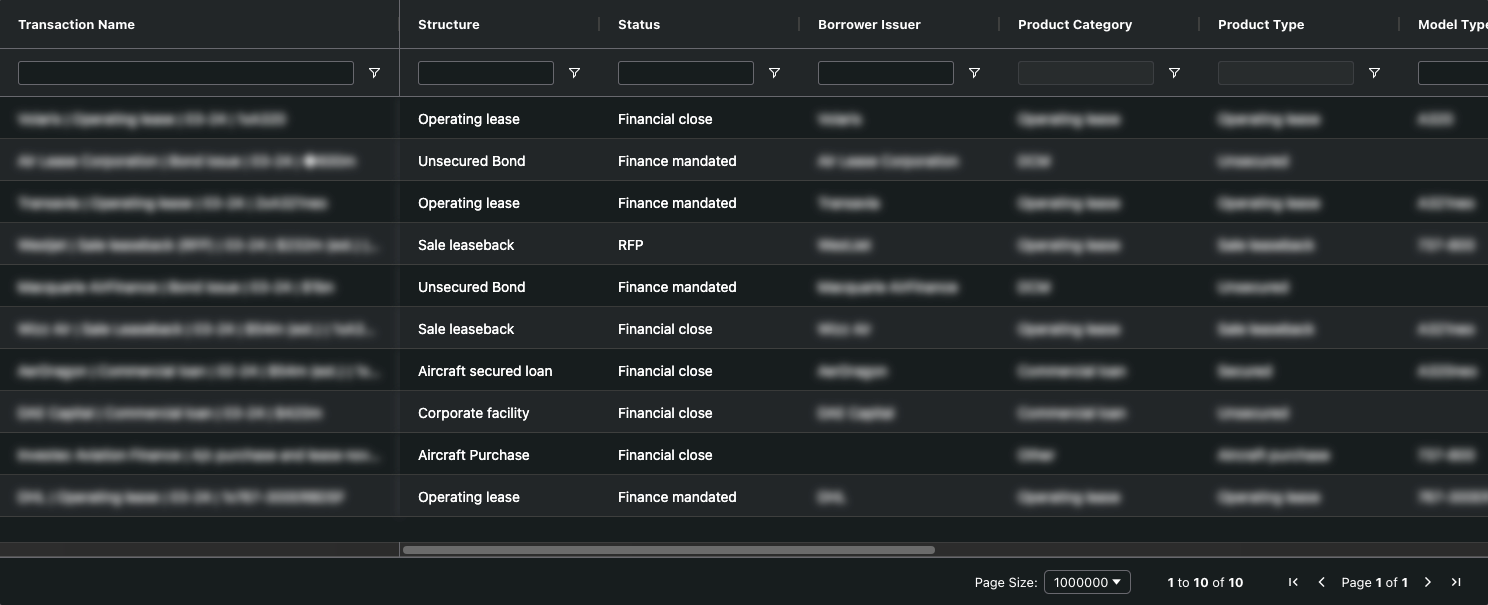

Latest Deals

Latest Analysis

Airfinance Journal Rising Stars: part 1

In part 1, Airfinance Journal recognises three of the six most promising legal associates for 2023

Secured facility will fund 2024 growth: SES

Airfinance Journal talks to Shannon Engine Support about its inaugural secured RCF and investments in the first half. Last November the lessor closed the largest engine portfolio financing with eight banks. Chief commercial officer Tadhg Dillon points to acceleration and growth of the business over the past three years as the driver behind the engine portfolio facility

Aviation Investment Bankers 2024 Bonus Roadmap - Surfin' ...

A total of 7 lessors have now published their results for their financial years ended 31 December 2023. In aggregate they have reported total debt repayment obligations in 2024 of $19.4bn and capital expenditure commitments of $23.4bn

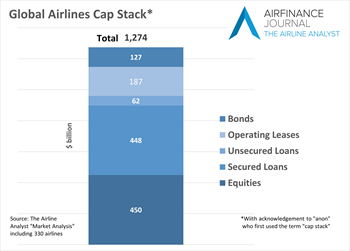

The $1.3 Trillion Airline "Cap Stack"

At $1.3 trillion we might not be as large as real-estate, autos, chemicals or telecoms but we are certainly deserving of attention from investors, bankers, lessors, consultants and global service firms alike.